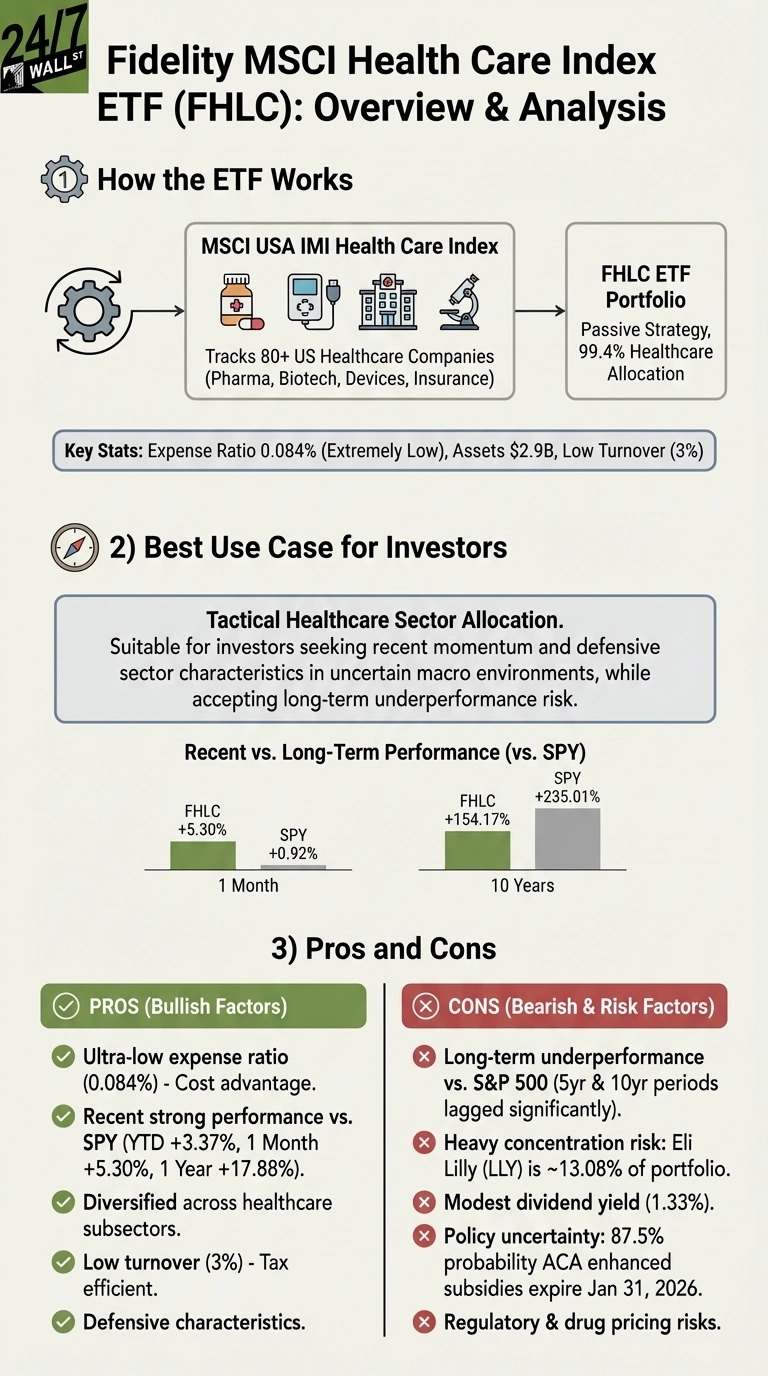

Fidelity’s MSCI Health Care Index ETF (NYSEARCA: FHLC) is under scrutiny as investors evaluate its performance and future potential. With an expense ratio of just 0.084%, the fund aims to provide low-cost exposure to the U.S. healthcare sector. Over the past year, FHLC has gained 17.9%, but a closer look reveals a significant concentration risk and long-term underperformance compared to the S&P 500, which returned 235% over the past decade.

Understanding FHLC’s Structure and Performance

FHLC tracks the MSCI USA IMI Health Care Index, encompassing a diverse range of U.S. healthcare companies involved in pharmaceuticals, biotechnology, medical devices, and health insurance. Despite its low fees and over 80 holdings, the fund carries a substantial risk due to its heavy reliance on a few key stocks. Notably, Eli Lilly (NYSE: LLY) constitutes over 13% of the portfolio, tying FHLC’s performance closely to the success of GLP-1 obesity drugs. Eli Lilly’s stock has surged 46% in the past year, but such concentration raises concerns about the fund’s stability.

While FHLC has performed well recently, gaining 5.3% over the past month, its long-term results tell a different story. Over the past five years, the ETF returned 42.6%, significantly trailing the S&P 500’s 84.5%. This underperformance is attributed to various challenges facing the healthcare sector, including drug pricing pressures and slower innovation rates outside of oncology and rare diseases.

Potential Risks and Alternatives for Investors

Investors in healthcare must navigate a landscape marked by political and regulatory uncertainty. Currently, there is an 87.5% probability that enhanced ACA premium tax credits will expire by the end of January 2026. Such changes could adversely affect health insurers, including UnitedHealth (4.5% of FHLC), which has already seen its stock decline 31% over the past year.

Income-focused investors may find FHLC’s yield of 1.33% less attractive compared to other sectors. The fund has managed to grow dividends at approximately 4.6% annually over five years, a rate that barely keeps pace with inflation. This modest yield may not meet the income needs of retirees or those prioritizing steady returns.

For investors seeking alternatives, the Vanguard Health Care ETF (NYSEARCA: VHT) may be worth considering. VHT charges a slightly higher expense ratio of 0.09% and boasts assets of $20.4 billion compared to FHLC’s $2.9 billion. The larger asset base can provide better liquidity and tighter bid-ask spreads. Additionally, VHT offers a slightly higher dividend yield of 1.38%.

In summary, while Fidelity’s Health Care ETF offers an entry point into the healthcare sector, its concentration in a few key stocks and historical underperformance relative to the broader market warrant careful consideration. Investors should assess their risk appetite and income needs before committing to this fund.