The biopharmaceutical sector is poised for a significant surge in merger and acquisition (M&A) activity in 2026, driven by a rejuvenated bull market that has enabled major companies to allocate more capital for strategic deals. According to a report released by EY (formerly known as Ernst & Young) during the 43rd Annual J.P. Morgan Healthcare Conference, the total capital earmarked for M&A among the top 25 biopharma firms has climbed to $1.6 trillion, up from $1.3 trillion in 2025. This increase in available capital has contributed to a remarkable 66% rise in the value of biopharma M&A transactions, reaching $149 billion from $90 billion in the previous year.

Despite the anticipated rise in M&A activity, the market for initial public offerings (IPOs) is not expected to see a corresponding rebound. Subin Baral, EY’s global life sciences deals leader, noted that the IPO market remains sluggish as investors continue to favor more established companies with proven drug candidates. In 2025, there were only 76 M&A deals, a decline from 94 in 2024, but with a marked increase in deal value.

Market Dynamics and Future Expectations

Baral emphasized that the robust fundamentals of the biopharma industry, including rapid innovation and breakthroughs in various therapeutic areas, will drive M&A activity moving forward. Notably, neuroscience has seen a significant increase in M&A spending, totaling $83 billion in 2025, second only to oncology, which accounted for $146 billion. Baral stated, “We expect the surge to continue into 2026. The industry fundamentals continue to remain strong.”

This surge in M&A can be attributed partly to the looming “patent cliff,” where major biopharma companies are set to lose exclusivity on several blockbuster drugs, leading them to seek new avenues for revenue generation. A recent analysis indicated that the top 20 drugs facing patent expiration between 2026 and 2029 represented sales of $176.4 billion in 2024, accounting for a substantial portion of the anticipated revenue loss.

Notable Market Movements and Innovations

Recent M&A activities have already influenced stock movements within the industry. For instance, shares of Ventyx Biosciences surged approximately 37% after Eli Lilly announced its intention to acquire the company. Similarly, Revolution Medicines experienced a nearly 29% increase following speculation about a potential acquisition by AbbVie—a claim that AbbVie later denied.

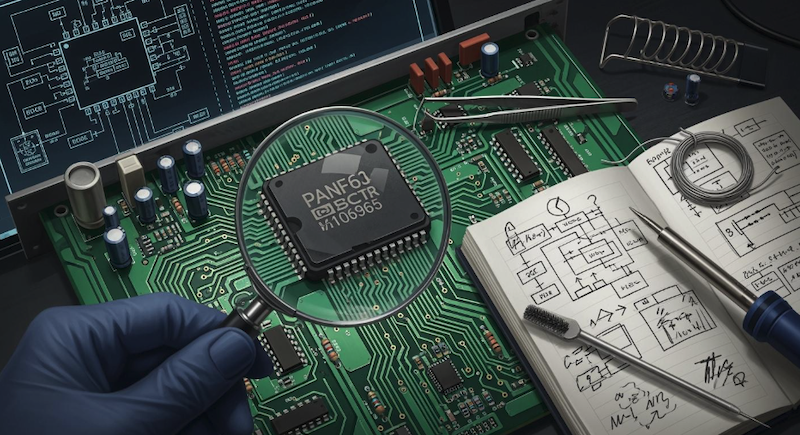

Furthermore, the rise of artificial intelligence (AI) in biopharma is reshaping the landscape of M&A. The EY report highlighted a staggering 256% increase in the potential value of life sciences deals targeting AI technology, illustrating the industry’s commitment to optimizing research and development processes.

Baral pointed out that while M&A activity is set to increase, the IPO market is unlikely to follow suit. In 2025, IPOs in the biopharma sector fell to $1.755 billion by September 30, marking a 56% decline from the previous year. The recent IPOs of MapLight Therapeutics and Evommune raised $251 million and $150 million respectively, but these figures do not indicate a substantial recovery.

As the biopharmaceutical sector navigates these challenges and opportunities, the focus will remain on leveraging M&A to foster innovation and drive value creation for patients. The landscape is poised for change, with companies looking to capitalize on both the promise of AI and the evolving global dynamics, particularly in regions like China, which has emerged as a significant player in biopharma innovation.