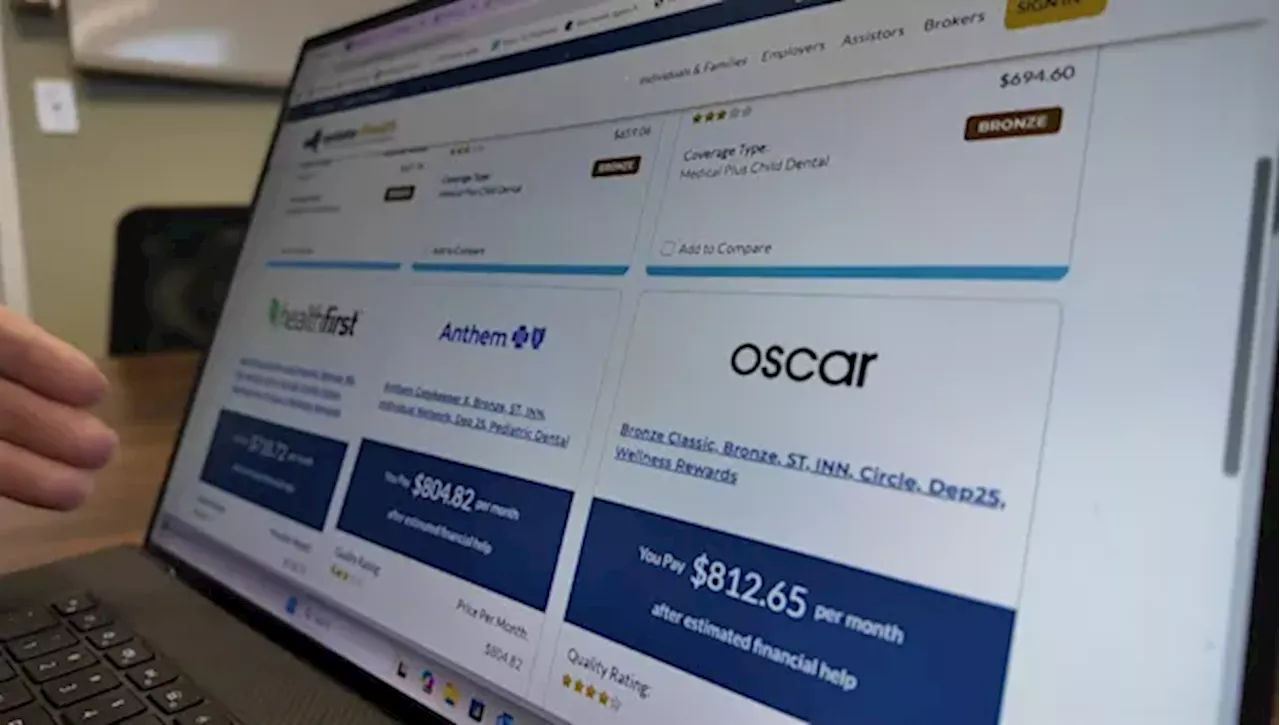

The deadline for enrollment in Affordable Care Act (ACA) health insurance plans is fast approaching, set for January 5, 2026. This year marks a significant increase in healthcare costs for many Americans, particularly for those who rely on the ACA for coverage. Changes in legislation have led to rising premiums, leaving many individuals and families facing tougher financial decisions.

Lawmakers did not renew enhanced cost savings that had previously helped reduce insurance premiums, causing prices to climb. For residents in Long Island, like Jonathan Silberstein, the increase has been particularly burdensome. According to insurance broker James Donnelly, some clients have seen their monthly costs rise by more than $100. He noted, “Can they pay for soccer for their children, can they pay for that extracurricular activity, because that’s a monthly payment that’s now going up?”

Enrollment Options and Special Circumstances

Thursday marks the final opportunity for individuals to enroll or renew their ACA coverage for the remainder of the year. While many may feel pressure due to the rising costs, there are provisions in place for those experiencing significant life changes. Donnelly explained that certain qualifying events could allow individuals to enroll or change their plans outside the standard enrollment period. “You have special election periods if there’s life changes, so if you have a sudden loss of income, if you have a new child, if you move,” he stated.

As the enrollment deadline nears, potential enrollees are encouraged to carefully evaluate their options. The rising costs of healthcare under the ACA have led to some alarming trends in enrollment numbers across the country. Reports indicate that approximately 800,000 fewer Americans have signed up for ACA plans this year compared to last, marking a 3.5% decline. This decrease is largely attributed to the expiration of federal subsidies that had previously helped to lower premium costs.

Market Response and Future Implications

The current situation has sparked concerns about the accessibility and affordability of health insurance. Many individuals may now face difficult choices regarding their healthcare coverage, particularly as they receive their first bills reflecting the new premiums. This decline in enrollment is occurring against a backdrop of ongoing political discussions in Congress about the future of ACA subsidies and potential reforms.

In Texas, a contrasting trend has emerged, where enrollment in ACA plans surged despite the expiration of subsidies, with over 4.11 million Texans selecting a plan as of January 3, 2026. This figure indicates a more robust marketplace than many had anticipated, suggesting that some regions may be better able to adapt to the changes in cost structure.

The situation remains fluid as policymakers deliberate on potential measures to address the rising healthcare costs and to support those impacted by the changes. As the deadline approaches, it is crucial for individuals to assess their healthcare needs and explore their options before the opportunity to enroll closes.