Arvin Capital Management LP has significantly reduced its stake in Meta Platforms, Inc. by 88.8% during the second quarter of 2023. According to its latest 13F filing with the Securities and Exchange Commission, the investment firm now holds 4,796 shares of Meta, down from 38,158 shares sold in the quarter. The remaining shares represent approximately 0.7% of Arvin Capital’s investment portfolio, positioning Meta as its 25th largest holding.

As of the most recent filing, Arvin Capital’s holdings in Meta were valued at around $3,540,000. The firm is not alone in its market maneuvers; other institutional investors have also adjusted their positions in Meta. For instance, Hel Ved Capital Management Ltd acquired a new stake valued at $5,049,000 during the same period.

Columbus Hill Capital Management L.P. increased its holdings in Meta by 10.7%, now owning 75,376 shares valued at $55,634,000. Similarly, MIG Capital LLC raised its stake by 8.0%, bringing its total to 79,453 shares worth $58,643,000.

The trend continues with Pinpoint Asset Management Singapore Pte. Ltd., which purchased a new stake valued at approximately $1,360,000, and Silphium Asset Management Ltd, which lifted its holdings by 6.9%, now owning 9,590 shares valued at $7,078,000. Overall, institutional investors own about 79.91% of Meta’s stock.

Insider Transactions Highlight Market Activity

In other developments, Meta’s Chief Financial Officer, Susan J. Li, sold 6,875 shares on November 15, 2023, at an average price of $609.46, totaling approximately $4,190,037.50. Post-sale, Li holds 88,370 shares, valued at about $53,857,980.20, reflecting a 7.22% decrease in her position.

Additionally, Chief Technology Officer Andrew Bosworth sold 11,690 shares on November 18, 2023, for a total of $6,935,793.90, resulting in an 82.88% decrease in his ownership. In total, insiders have sold 41,959 shares valued at $26,671,107 in the last quarter, with corporate insiders owning 13.61% of the stock.

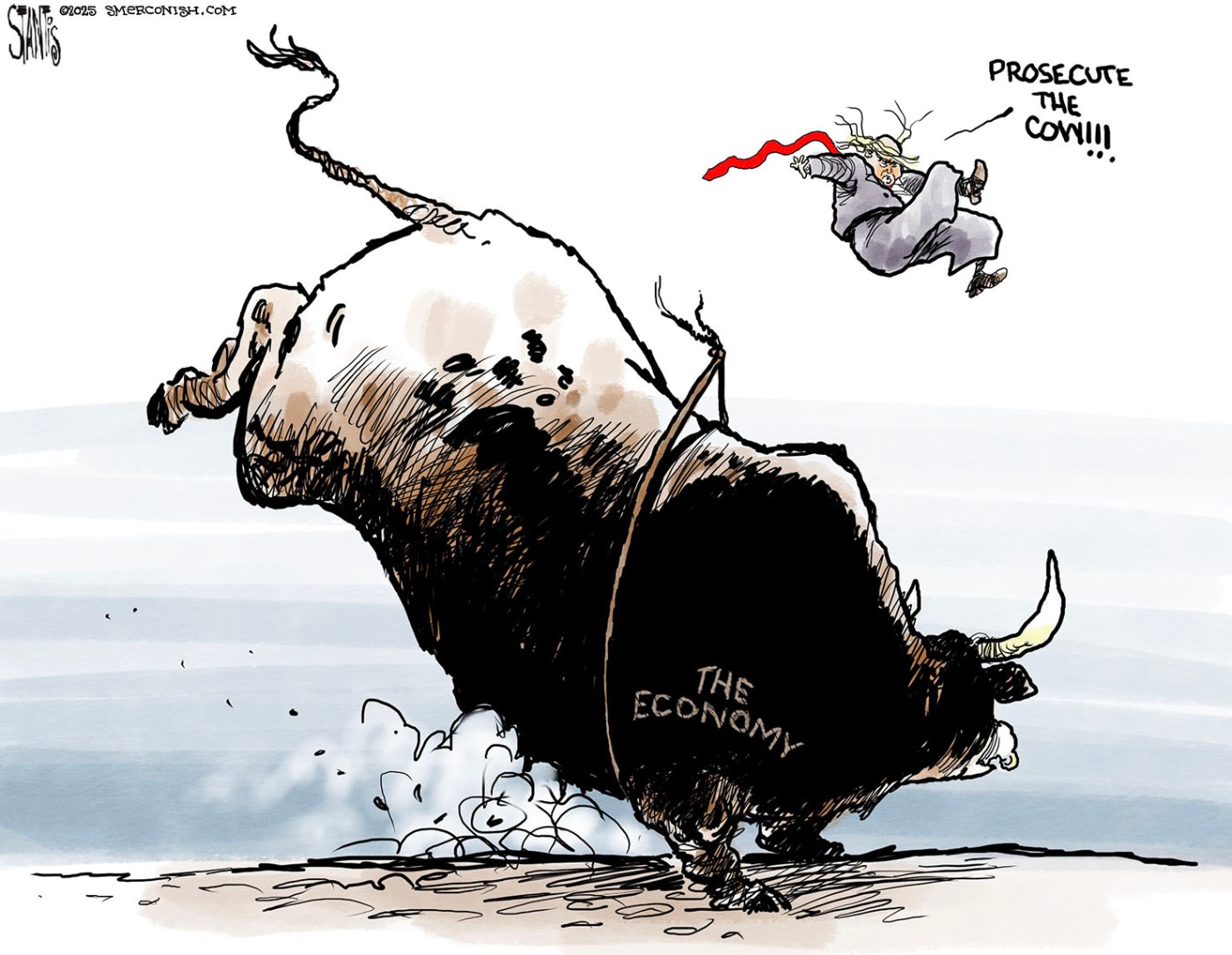

Meta Platforms’ Market Performance and Future Outlook

Shares of Meta Platforms (NASDAQ: META) opened at $661.53 on Friday. The company’s stock has fluctuated significantly, with a 52-week low of $479.80 and a high of $796.25. Meta currently has a market capitalization of $1.67 trillion, a P/E ratio of 29.22, and a P/E/G ratio of 1.34.

In its latest quarterly earnings report released on October 29, 2023, Meta reported earnings of $7.25 per share, surpassing analysts’ expectations of $6.74 by $0.51. The company achieved revenue of $51.24 billion, significantly exceeding the forecast of $49.34 billion, reflecting a year-over-year revenue increase of 26.2%.

Looking ahead, analysts forecast that Meta Platforms will achieve an earnings per share figure of 26.7 for the current fiscal year. The company also recently announced a quarterly dividend of $0.525, which will be paid on December 23, 2023, to shareholders of record by December 15, 2023. This dividend translates to an annualized rate of $2.10, yielding 0.3%.

As market analysts continue to evaluate Meta’s stock, several firms have recently adjusted their ratings. TD Cowen lowered its target price from $875.00 to $810.00, assigning a “buy” rating. Raymond James Financial maintained a “strong-buy” rating with a new target of $825.00, down from $900.00. Conversely, Benchmark downgraded its rating from “buy” to “hold”.

Overall, Meta Platforms continues to be a focal point for both institutional investors and market analysts as it navigates a competitive landscape while maintaining robust financial performance.