China’s economic growth for 2025 is projected at a mere 2.5 percent, significantly lower than the official target of 5 percent, according to a December 22 report by the Rhodium Group. This estimate has raised concerns among analysts, who suggest that the actual economic conditions may be even bleaker than indicated. The Chinese government reported a growth rate of 5.2 percent for the third quarter of 2024, which many experts view skeptically.

The Rhodium Group attributes this drastic discrepancy to a substantial decline in fixed asset investment, particularly in the latter half of the year. The report notes, “History offers no examples of economies that have recorded 5 percent real GDP growth while facing years of persistent deflation, as China has for ten consecutive quarters.” Such a scenario raises doubts about the credibility of the official figures.

Gao Shanwen, chief economist at SDIC Securities, echoed these sentiments by stating that China’s actual GDP growth over the last two to three years likely hovered around 2 percent, a stark contrast to the nearly 5 percent figure reported by the government. Following his remarks, Gao faced repercussions, including a ban on public speeches and a resignation from his position.

Further complicating the economic landscape, Davy J. Wong, an independent economist, highlighted the conflicting methodologies between different economic analyses. He explained that the Rhodium Group’s estimates illustrate a critical drop in investment in the second half of 2024, particularly within fixed assets and real estate sectors, which contradicts the official narrative promoted by the Chinese government.

At the recent Chinese Communist Party’s Central Economic Work Conference, President Xi Jinping made a rare admission by criticizing officials for inflating economic data, stating the need to pursue “genuine, unadulterated growth.” This acknowledgment could signify internal recognition of the challenges facing the Chinese economy.

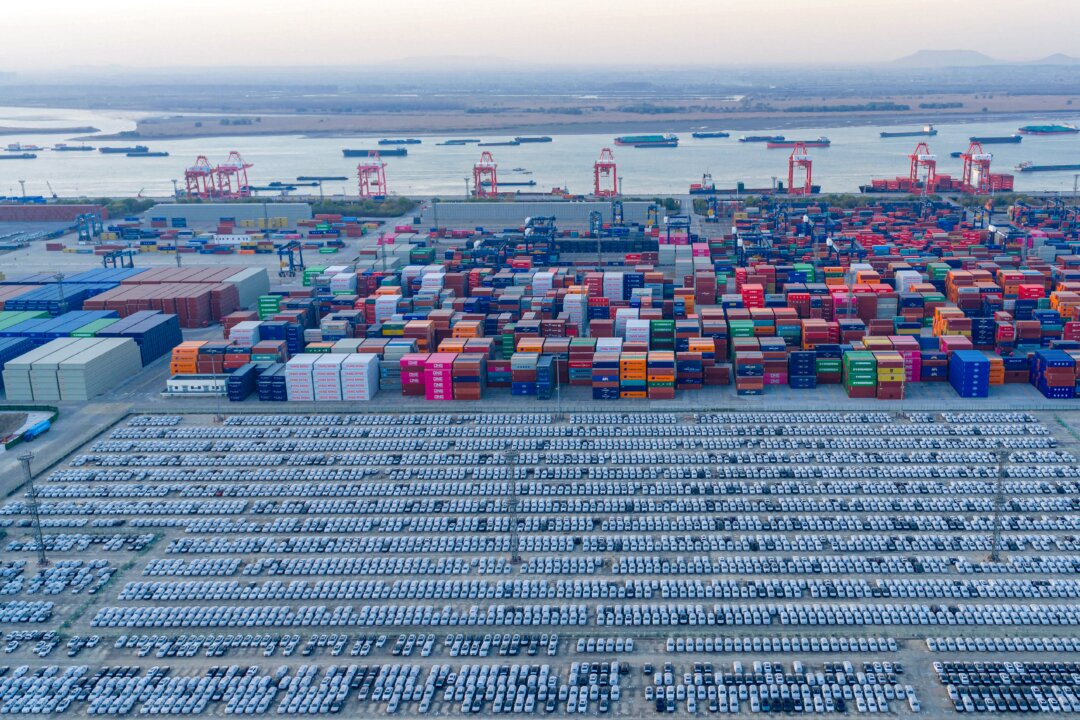

Recent data from the National Bureau of Statistics of China reflects a comprehensive decline in various economic sectors. From January to November, fixed asset investment fell by 2.6 percent year-over-year, worsened from a 1.7 percent decline between January and October. Additionally, national real estate development investment saw a staggering decrease of 15.9 percent year-over-year.

The statistics paint a grim picture: utilized foreign investment in the first eleven months totaled 693.18 billion yuan (approximately $98.6 billion), down by 7.5 percent year-over-year. Retail sales and industrial output also demonstrated slower growth, further indicating an economic slowdown.

As economic conditions worsen, some pensioners in cities like Chongqing are resorting to selling local produce for meager earnings, highlighting the human impact of the economic downturn.

Looking ahead, the Rhodium Group forecasts that China’s economic growth for 2026 may only reach between 1 percent and 2.5 percent, falling short of the 4.5 percent growth rate projected by the International Monetary Fund (IMF). Wong remarked on the divergence between the two organizations, noting that while the IMF focuses on macroeconomic data, the Rhodium Group takes a more nuanced approach examining economic structure and market health.

American businesses are likely to remain cautious in their investment decisions, particularly as the trend of multinational corporations withdrawing from China continues amidst growing uncertainties about the country’s economic future. The shift in focus from traditional markets in Europe and the United States to regions such as Southeast Asia and Africa further reflects the changing dynamics of global trade.

The ongoing economic challenges underscore the need for transparency and accurate data within China, as the credibility of reported figures continues to come under scrutiny.