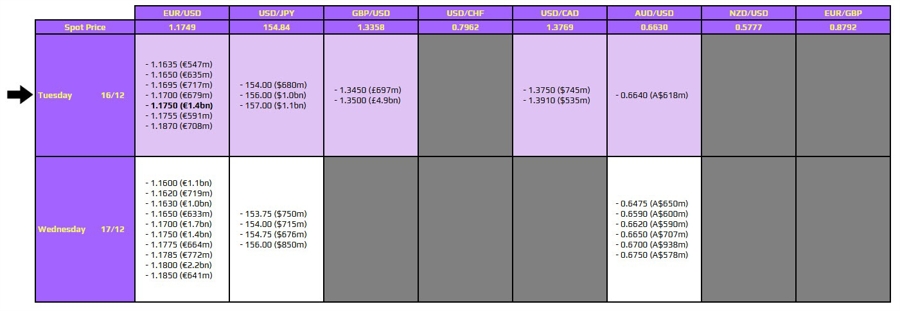

The foreign exchange market is gearing up for an important event on December 16, 2023, with a notable expiry for EUR/USD at the 1.1750 level. This expiry, while not tied to any specific technical indicators, has the potential to influence price movements ahead of significant economic data from the United States later in the day.

Market Dynamics Ahead of Key Data Releases

As traders prepare for the expiry, attention will shift to the release of key economic indicators. The Euro area is set to publish its Purchasing Managers’ Index (PMI) data, which could add some volatility to market activity during European trading hours. However, analysts suggest that unless there are unexpected results, the movement in EUR/USD may remain subdued until the release of the US jobs report and retail sales data later in the day.

The significance of the EUR/USD expiry can act as a price magnet, drawing attention as market participants look to position themselves ahead of the crucial economic indicators. This level may serve as a reference point for traders, influencing decisions and strategies in the lead-up to the data releases.

What to Watch For

Investors should monitor the economic releases closely, particularly the US jobs report, which offers insights into employment trends and economic health. Additionally, the retail sales data will provide information on consumer spending, a vital component of the US economy.

For those interested in detailed analysis and trading strategies related to this data, resources are available on platforms such as investingLive, which offers insights and updates on market movements.

As the day unfolds, traders will be keen to see how the expiry of the EUR/USD option at 1.1750 impacts market dynamics, especially in light of the economic data anticipated from the United States.