The recent sell-off in the software industry, triggered by fears surrounding artificial intelligence, has led to a significant market value loss estimated at around $300 billion as of February 3, 2023. Morgan Stanley analyst Meta Marshall suggests this downturn presents a unique opportunity for investors, as the demand for cybersecurity solutions is poised for substantial growth. Marshall argues that AI not only expands the attack surface but also enhances the capabilities of cybercriminals.

Marshall highlights that AI’s integration into cybersecurity is critical due to its dual role in both creating vulnerabilities and necessitating advanced security measures. The advent of large language models (LLMs) has increased the potential points of attack, as these systems can be susceptible to prompt injection attacks and may inadvertently disclose sensitive information. As AI-generated code often contains security flaws, the need for robust cybersecurity investments becomes imperative to safeguard organizations against AI-based threats.

Cybersecurity Market Poised for Growth

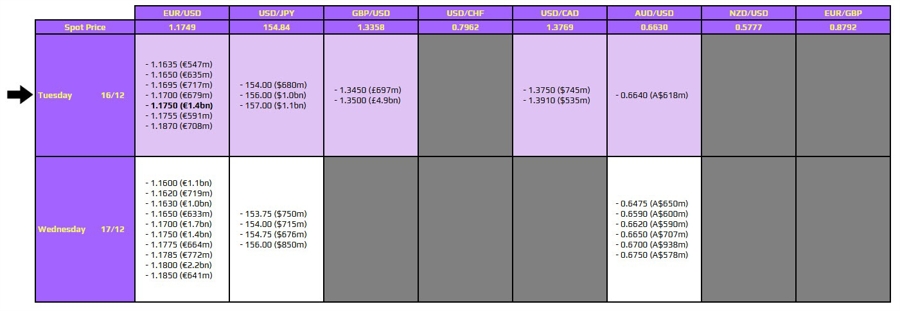

According to Marshall, the urgency for enhanced security spending is underscored by alarming statistics: 14% of organizations have reported experiencing an AI-related breach, while 16% of breaches involved the use of AI. Marshall estimates that if the intensity of security spending aligns with IT spending, the AI security market could exceed $45 billion in the coming years, a marked increase from approximately $16 billion today, translating to a compounded annual growth rate (CAGR) of 30-40%.

Marshall’s analysis also emphasizes that recent trends indicate an increase in the frequency and effectiveness of cyberattacks. This growing concern has prompted heightened scrutiny and investment in cybersecurity solutions.

Top Recommendations from Morgan Stanley

Marshall expresses particular optimism about several key players in the cybersecurity sector. She advocates for CrowdStrike (CRWD), maintaining an equal-weight rating with a price target of $537. As of February 14, 2023, CrowdStrike’s stock price stood at $429.64, reflecting an 8.35% decline year-to-date, yet suggesting a potential upside of nearly 25%. The company is scheduled to announce its earnings on March 3.

Another firm under Marshall’s scrutiny is Palo Alto Networks (PANW), for which she has issued an overweight rating and a price target of $245. The stock is currently priced at $166.95, down 9.36% year-to-date, but with a projected upside of around 47%. Palo Alto Networks will report its earnings on February 17.

Beyond these prominent firms, Marshall identifies several lesser-known stocks as attractive long-term investments. Zscaler (ZS), SentinelOne (S), Netskope (NTSK), and SailPoint (SAIL) have all experienced declines this year, providing what Marshall considers compelling entry points for investors.

For Zscaler, Marshall anticipates an upside to consensus estimates for Q2 annual recurring revenue (ARR) of 24% to 25% year-over-year, despite a projected negative seasonality effect. She has reiterated an overweight rating with a price target of $305. Zscaler’s stock, currently at $177.72, indicates a potential upside of 71% and will report earnings on February 26.

SailPoint is also on Marshall’s radar, where she predicts an increase in total ARR to $1,122 million, reflecting a year-over-year growth of 28%. Her price target for SailPoint stands at $25, with the stock currently valued at $15.92, yielding a potential upside of 57%.

Meanwhile, SentinelOne is expected to report Q4 revenue modestly exceeding management’s guidance of $271 million, suggesting around 20.2% year-over-year growth. Marshall maintains an equal-weight rating and a price target of $18, with the stock at $13.87, offering an upside of nearly 30%. The company’s earnings are due on March 12.

Marshall believes that Netskope will achieve more than 30% year-over-year ARR growth in Q4, with revenue expected to surpass consensus estimates at approximately 27.5% year-over-year. She reiterates an overweight rating with a price target of $27. Netskope’s current stock price of $11.89 suggests an impressive potential upside of 127%, with earnings to be announced on March 11.

The analysis from Morgan Stanley underscores the significant potential for growth within the cybersecurity market. As the integration of AI continues to evolve, the demand for effective security solutions is expected to drive substantial investment in the sector.