The recent military action by the United States in Venezuela has drawn attention to the country’s substantial oil reserves, which total approximately 303 billion barrels. This vast stockpile holds significant implications for global crude oil prices, which directly affect the amount consumers pay at the fuel pump. As the situation develops, analysts are closely monitoring how these events might influence oil supply and pricing dynamics.

Venezuela’s oil, despite representing nearly 20% of the world’s total reserves, currently contributes less than 1% of daily global crude production. This limited output suggests that even with potential fluctuations in oil supply due to geopolitical tensions, immediate impacts on prices may be muted. Analysts note that while the situation is precarious, the country’s oil infrastructure reportedly remained intact following the recent US military operations, minimizing possible disruptions to production.

Market Reactions and Future Projections

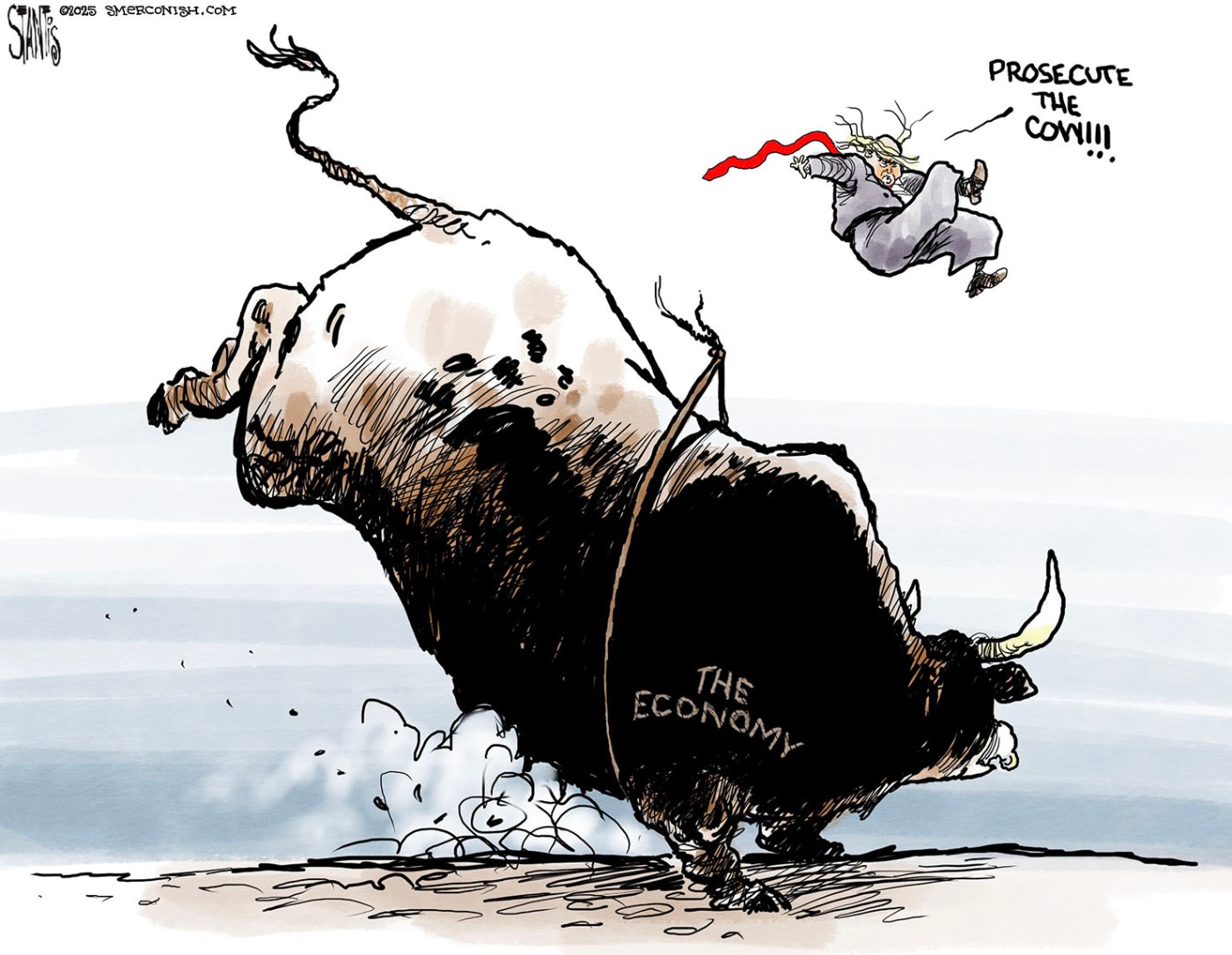

While the commodity markets do not operate over the weekend, any upcoming price movements are likely to hinge on how the geopolitical landscape in Venezuela evolves. The anticipated global oil surplus is projected to reach a record high by 2026, which could further dampen crude prices. The US government’s expressed interest in tapping into Venezuelan oil reserves may add to the already existing surplus, leading to a potential decline in prices. This scenario poses a dilemma for US companies considering drilling in Venezuela; increased production might lead to lower prices, reducing profit margins for their operations.

In recent months, crude oil prices have seen a significant decline, especially since the start of last year. The interplay between increased supply and stagnant demand will be crucial in determining future price trajectories. As the market adjusts, consumers may experience changes in fuel costs, prompting discussions about the broader economic implications of oil price volatility.

The ongoing situation in Venezuela serves as a reminder of the interconnectedness of international events and everyday consumer experiences. As developments unfold, the response from both the market and policymakers will be critical in shaping the future landscape of global oil supply and pricing.