As the landscape of retirement shifts, individuals must adapt their strategies to ensure financial security in an increasingly uncertain environment. Traditional retirement planning models, which often relied on fixed income percentages and predictable expenses, are becoming outdated. With rising life expectancy, escalating healthcare costs, and market fluctuations, the notion that saving just 10% of one’s income will suffice is no longer realistic.

Adapting to New Realities

The retirement rules of earlier generations were predicated on several assumptions that no longer hold true. Many people worked for a single employer for their entire careers, pensions were commonplace, and retirement looked largely the same for everyone. Today, these assumptions are rapidly changing. According to data, the average retirement age in the United States is approximately 62 years, with full retirement age for Social Security ranging from 66 to 67 years based on birth year.

Life expectancy has also increased, with men averaging around 75 years and women typically living five years longer. Nearly 60% of couples aged 62 will have at least one spouse reaching 90 years. This longevity necessitates a reevaluation of retirement savings, as individuals may spend decades relying on their retirement funds.

The Financial Implications of Longevity

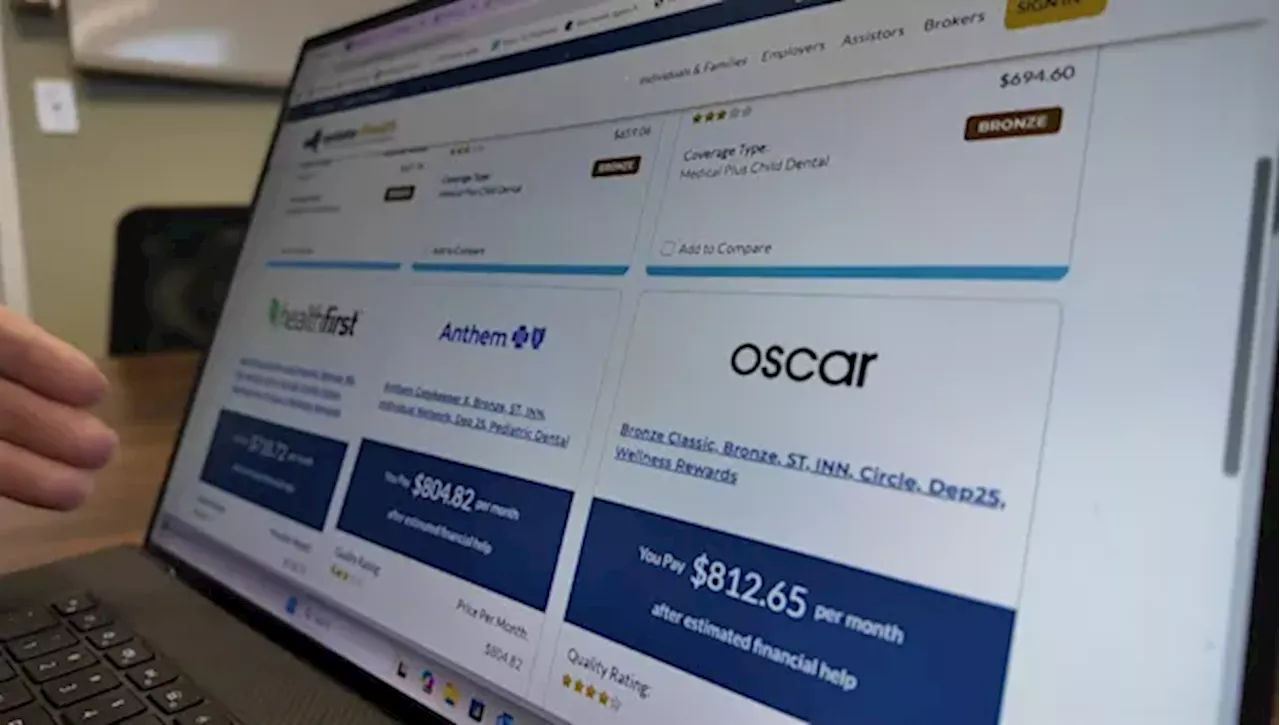

Living longer has significant financial implications that many overlook. Inflation continues to affect the purchasing power of retirement savings, which means that the amount needed for a comfortable retirement today may be inadequate in the future. Additionally, healthcare costs are a pressing concern. The average retired couple can expect to spend approximately $330,000 on healthcare throughout their retirement, excluding long-term care or mental health services.

Furthermore, as individuals age, they may face rising costs associated with assisted living or enhanced healthcare needs. This reality underscores the importance of planning for both physical and mental health expenses in retirement. Emotional well-being is crucial, as many retirees experience isolation or anxiety, which can lead to further financial strain if mental health needs are not addressed.

The traditional view of retirement as a time of rest and relaxation is evolving. Many retirees are finding joy and purpose by staying active and engaged in their communities, whether through volunteer work, hobbies, or part-time positions. This shift reflects a growing understanding that retirement can be an opportunity for personal growth and fulfillment.

Maintaining social connections plays a vital role in enhancing mental health and cognitive function. Research indicates strong social ties contribute to better health outcomes and longevity, emphasizing the need for retirees to build support networks within their communities.

Preparing for a Successful Retirement

Financial preparedness is no longer the sole focus of retirement planning. Emotional readiness and lifestyle choices are equally important. Individuals should strive to create a fulfilling environment that encourages social interaction, physical activity, and a sense of purpose.

As retirement approaches, engaging with financial advisors and exploring strategies that extend beyond mere savings can lead to a more enriching experience. It’s essential to consider not just the financial aspects of retirement but also how to cultivate a lifestyle that supports well-being and satisfaction.

The evolving retirement landscape requires individuals to rethink traditional models. By understanding the complexities of longevity, healthcare expenses, and the importance of social engagement, retirees can navigate this new reality effectively. Ultimately, retirement should be viewed as a redefinition of life, where individuals can pursue their passions and enjoy their golden years with confidence and joy.