The Supreme Court is set to determine whether President Donald Trump has the authority to dismiss members of the Federal Reserve, specifically targeting Governor Lisa Cook. This pivotal case highlights the balance of power between the presidency and independent agencies, particularly in light of the Fed’s significant influence over the economy. Oral arguments are scheduled for September 27, 2023, as the justices examine a contentious issue that could reshape the relationship between the executive branch and the central bank.

The conflict arose after Trump attempted to remove Cook amid allegations of mortgage fraud, which she has denied. The case is particularly noteworthy as it could mark the first time a president has successfully fired a Fed governor in the institution’s 111-year history. The Supreme Court’s previous statements indicated a protective stance towards the Fed, suggesting it is “uniquely structured” to avoid political manipulation due to its historical significance and economic responsibilities.

Implications of Trump’s Actions

Legal experts are closely monitoring the implications of this case for presidential authority over independent agencies. Lev Menand, a law professor at Columbia University, emphasized that the ruling will clarify the extent of the president’s power regarding the Fed. “This case is about a lot more than Lisa Cook,” Menand stated. “We’re going to find out what’s the relationship between the central bank and the president.”

If the court sides with Trump, it could set a precedent that undermines the independence of the Federal Reserve, prompting concerns about market stability and governance. Cook has warned that a ruling in favor of the president would “eviscerate the independence” of the Fed, leading to “chaos and disruption” within U.S. markets.

The administration’s position hinges on the argument that Cook’s alleged misconduct justifies her removal under federal law, which permits the president to fire Fed members “for cause.” The Department of Justice contended that the Fed’s unique role in the U.S. economy necessitates a thorough examination of any ethical concerns involving its members.

Legal Context and Historical Precedent

The Supreme Court’s upcoming decision will address a complex legal landscape. In past cases, the court has allowed Trump to temporarily remove board members from agencies like the Federal Trade Commission and the National Labor Relations Board. However, those cases involved different legal principles and contexts. The court’s earlier emphasis on the Fed’s distinct status raises questions about applying similar reasoning to Cook’s situation.

In September, a federal court temporarily blocked Cook’s removal, ruling that Trump had not substantiated any allegations that pertained to her job performance. The appeals court in Washington, D.C., declined to stay that order, leading Trump to file an emergency appeal to the Supreme Court. The justices, instead of hearing the case as an emergency matter, opted for a full review, allowing Cook to remain in her position during the proceedings.

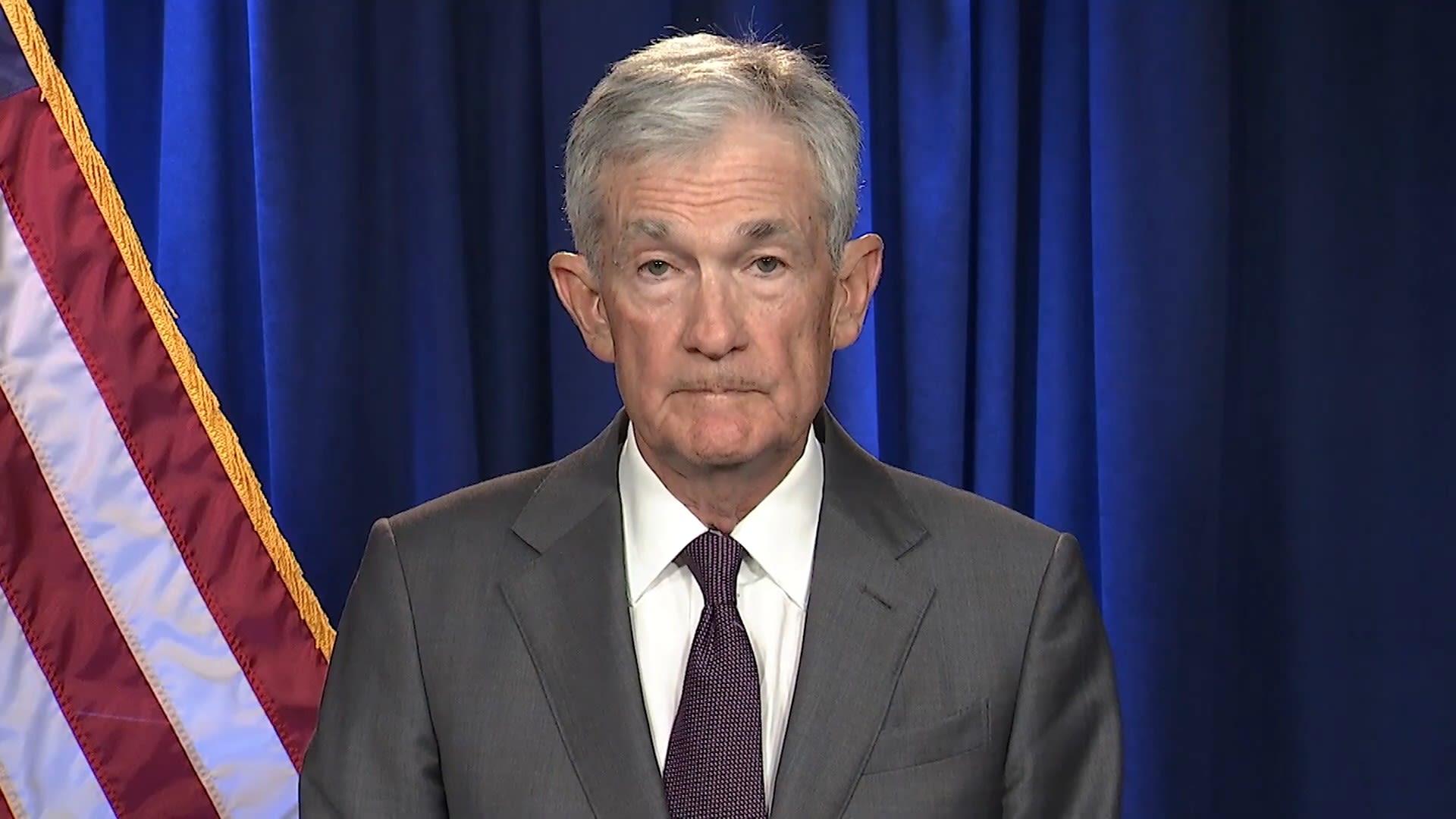

Critics of Trump’s approach argue that targeting Cook and Jerome Powell, the current Fed Chair, reflects an effort to exert political pressure on the central bank to adjust interest rates. The Fed has made interest rate cuts in response to economic conditions, rather than political influence, a point underscored by Cook’s support for such decisions.

As the Supreme Court prepares to hear this significant case, it is poised to clarify the boundaries of presidential authority over the Federal Reserve and set a critical precedent for the future governance of independent agencies in the United States.