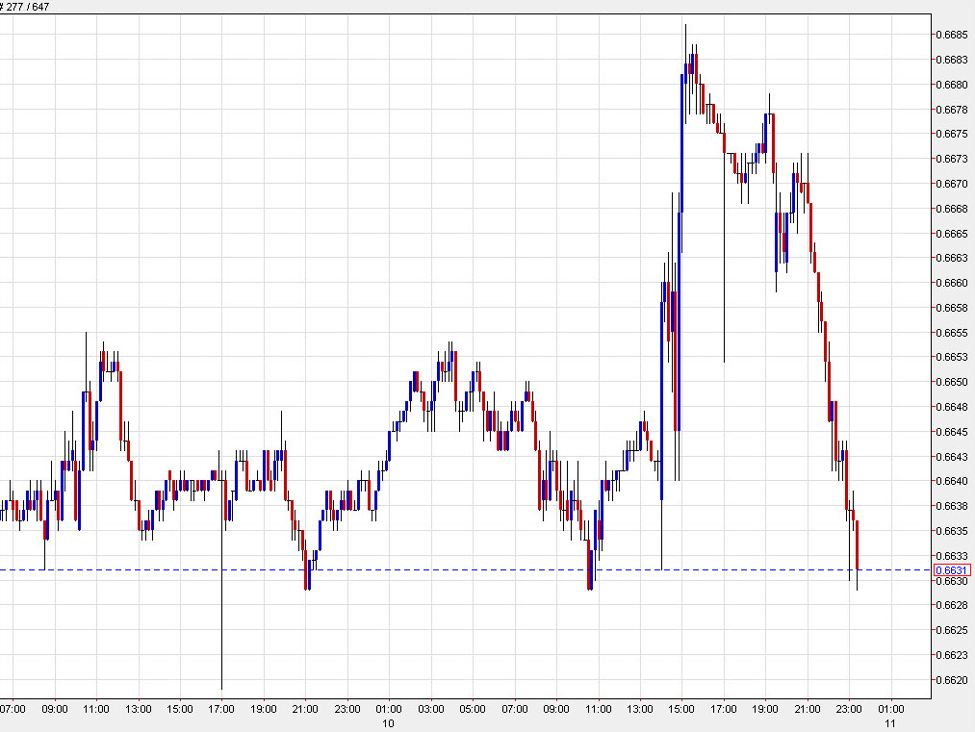

URGENT UPDATE: The Australian dollar (AUD) is experiencing a significant downturn in Asia today as it retracts from the gains made following the Federal Reserve’s announcements on Wednesday. This unexpected drop comes as traders engage in profit-taking following a brief attempt to sustain upward momentum.

Latest reports confirm that the AUD/USD pair is unwinding gains, mirroring trends seen in global stock markets. Early trading in Asia was characterized by an effort to push the Australian dollar higher, but enthusiasm quickly diminished, leading to a sharp reversal.

The decline in the AUD has been exacerbated by notable losses in Oracle Corporation shares, which fell sharply after their earnings report, prompting a widespread sentiment of caution across the markets. This indicates a growing concern among investors, particularly regarding the impact of AI-related spending.

Despite this setback, there’s a silver lining for the Australian economy. The Federal Reserve has raised its GDP forecast for 2026 to 2.3%, up from 1.8%, suggesting a potential boost for global growth and Australian commodity exports. However, this optimism is tempered by the recent struggles of Chinese stocks and a lack of confidence in Australia’s growth trajectory.

Traders and analysts are now closely monitoring the situation. “We may need to wait for a significant catalyst beyond the Fed’s announcements to truly influence market conditions,” said Adam Button, a financial analyst from InvestingLive.com.

As market participants assess these developments, the immediate future for the Australian dollar remains uncertain. Observers are keen to see how external factors, particularly concerning Chinese economic performance, will play out in the coming days.

For now, the Australian dollar’s performance serves as a crucial indicator for investors, reflecting broader economic sentiments. Stay tuned for updates as this situation evolves.