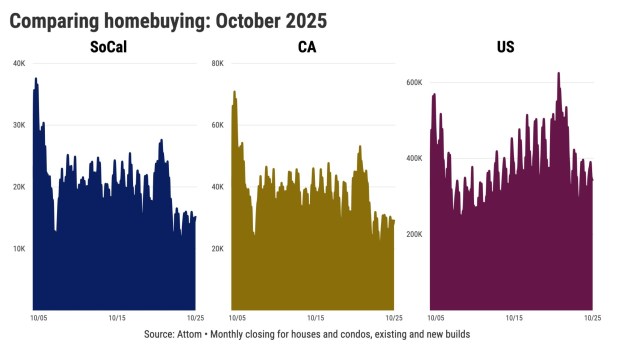

URGENT UPDATE: California home sales have plunged to their fourth-slowest October in 21 years, with 29,379 closed sales reported, according to real estate tracker Attom. This figure marks a staggering 22% drop below the monthly average since 2005, reflecting a significant downturn in the housing market as house hunters remain hesitant to buy.

Despite a recent dip in mortgage rates, buyers are not rushing to close deals amid ongoing economic uncertainty. California’s October sales revealed a 2.2% decline from last year, raising alarms about the state of the housing market. While homebuyers showed some activity over the past year with sales totaling 324,475—a 2% increase from the previous year—this total still falls 26% below the 21-year average.

The median selling price for homes in California stands at $735,125, a slight decrease of 0.5% year-over-year. However, this price point is just 2% (or $14,875) below the record high of $750,000 reached in May 2024. Buyers are stymied by these lofty prices, even as price appreciation cools. Over the past three years, home prices have surged by 9% after a breathtaking 35% rise during the pandemic, driven by historically low mortgage rates and a demand for larger living spaces.

The Federal Reserve’s interest rate hikes initiated in early 2022 aimed to combat rampant inflation, but the economic landscape has shifted. As of 2025, the Fed has begun lowering rates to stabilize the economy, yet buyers remain cautious.

Mortgage rates averaged 6.4% for the three months ending in October, unchanged from the previous year, but notably down from a recent peak of 7.4% in November 2023. These rates translate to a staggering typical monthly mortgage payment of $4,597 for California buyers. This burden is up 101% over the past six years, compounded by the need for a hefty $147,025 for a 20% down payment.

As the state grapples with these challenges, the emotional weight of high costs is palpable among potential buyers, many of whom are left questioning whether homeownership is still within reach.

What’s Next? Market watchers will be closely monitoring the housing market’s trajectory in the coming months as buyers navigate these challenging conditions. Will mortgage rate adjustments encourage more activity, or will prices continue to deter potential homeowners?

For ongoing updates, follow business columnist Jonathan Lansner from the Southern California News Group, who provides insights into this evolving situation.

The urgency of the current market dynamics cannot be overstated. As buyers reconsider their options, the future of California’s housing market hangs in the balance. Share this story to keep others informed about the rapidly changing landscape!