UPDATE: Central banks are re-evaluating their monetary strategies as gold surges in popularity, challenging the longstanding dominance of fiat currencies. This shift comes amid increasing concerns about the depreciation of paper money and the rising desire for tangible assets.

In a stunning turn of events, numerous central banks are now prioritizing gold in their reserves, a significant departure from previous trends where fiat currencies were favored. As of July 2023, the unrealized profit of the U.S. Treasury on its gold holdings has reached an astonishing $1 trillion. This comes as the Federal Reserve reports combined operating losses of approximately $1 trillion, raising serious questions about the viability of relying solely on printed money.

Historically, the U.S. dollar’s value has plummeted by an alarming 99 percent against gold since the Bretton Woods Conference in 1944. At that time, one dollar was worth 28.6 ounces of gold; today, it equates to just a fraction—about one-quarter of an ounce. This drastic decline highlights the urgent need for a reassessment of monetary policy.

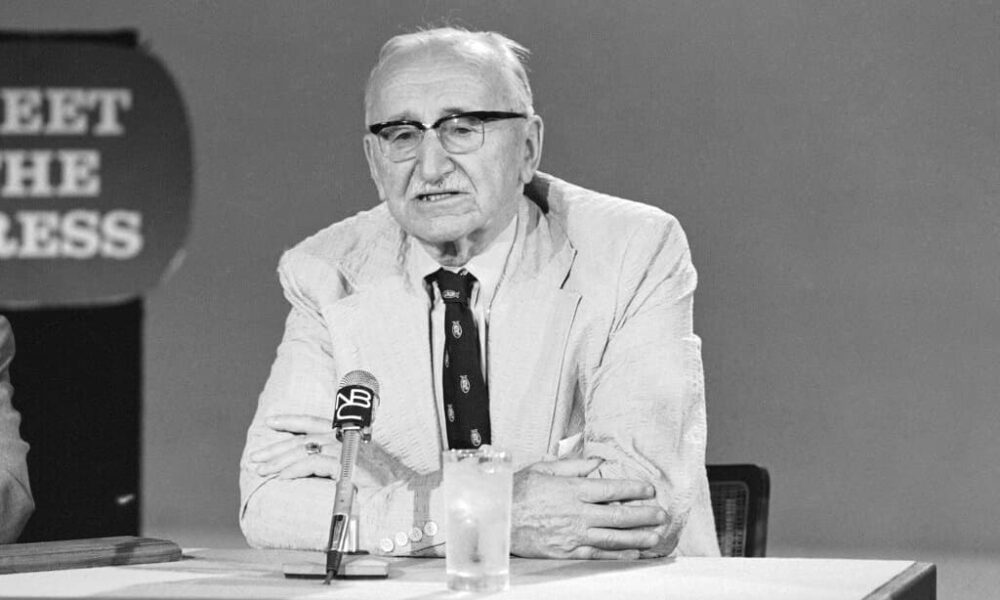

Renowned economist Friedrich Hayek warned against government monopolies on currency in his influential essay, “Choice in Currency.” Hayek argued for the necessity of competition in currencies, predicting that if citizens could choose their form of money, governments would be compelled to maintain its stability. “Let us deprive governments of all power to protect their money against competition,” he asserted. His ideas resonate strongly today as central banks grapple with the implications of fluctuating fiat currencies.

The recent surge in gold purchasing by central banks signifies a shift in strategy as they seek to safeguard against inflation and devaluation risks associated with fiat money. This development is being closely monitored as it could potentially redefine financial norms globally, suggesting that the era of unquestioned faith in fiat currencies may be nearing its end.

The emotional stakes are high for ordinary citizens who rely on stable currency for their savings and purchasing power. As central banks pivot towards gold, the potential for increased financial security may offer a glimmer of hope amid economic uncertainty.

Looking ahead, market analysts and economists are urging individuals to watch closely how this trend unfolds. Will gold reclaim its status as the ultimate safe haven, or will fiat currencies solidify their position? The implications for everyday consumers could be profound.

As this situation develops, the financial community is left to ponder if the lessons from Hayek’s foresight will prompt a more competitive and stable currency landscape. The call for currency choice is louder than ever, and the pressure is mounting on governments to adapt.

Stay tuned for further updates as this story evolves and the financial world reacts to these seismic shifts in currency dynamics.