UPDATE: New reports confirm that China’s global lending has surged to an astonishing $2.1 trillion, reshaping international relations and the landscape of global finance. This revelation comes from a recent study by Virginia-based research institute AidData, highlighting the scale of China’s financial influence worldwide.

The implications of this data are significant as China now stands as the world’s largest creditor, surpassing traditional powers like the United States. This lending boom, particularly evident during the 2010s through the Belt and Road Initiative, has positioned Beijing to outmaneuver its American rivals in securing strategic resources and diplomatic influence.

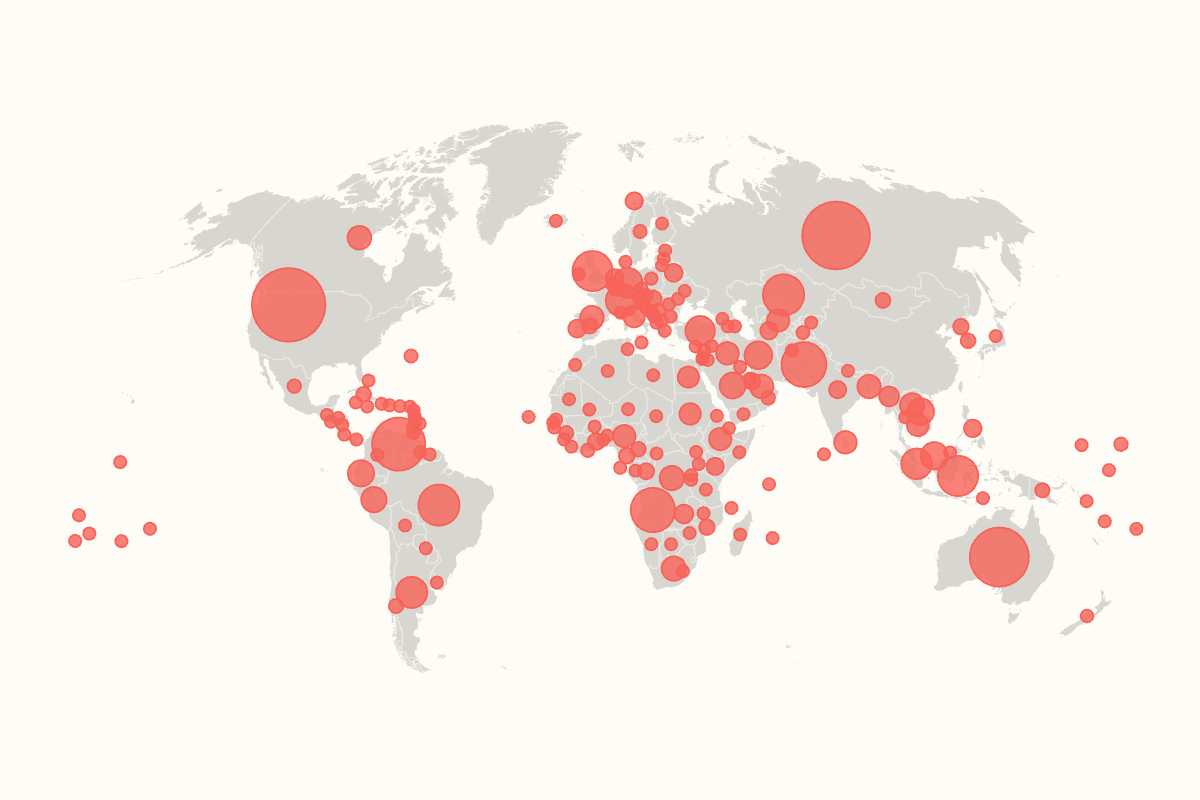

The AidData report, which analyzed 30,000 projects across 217 countries and territories over a three-year period, reveals that China’s lending portfolio is now two to four times larger than previous estimates. Notably, 76 percent of these loans went to high- and upper-middle-income nations, challenging assumptions that China’s financial support is primarily directed towards developing countries.

Among the top recipients, the United States leads with a staggering $202 billion in Chinese loans, funding over 2,500 projects nationwide. Following closely, Russia received $172 billion, while Australia ranked third with $130 billion in loans. Other significant recipients include Venezuela and Pakistan, with $105.7 billion and $75.6 billion, respectively. The United Kingdom rounds out the top ten.

The findings are particularly striking given that China does not disclose official data on its foreign lending. AidData’s analysis utilized loan contracts, grant records, and host-country documentation to compile these figures.

The discussion surrounding these loans has intensified, with critics labeling them as “debt-trap diplomacy,” suggesting that they impose burdensome repayment demands that could lead to financial distress for borrowing nations. However, Chinese officials reject this narrative, asserting that their lending practices are based on mutual benefits and market principles.

Brad Parks, executive director of AidData, stated,

“This is an extraordinary discovery given that the U.S. has spent the better part of the last decade warning other countries of the dangers of accumulating significant debt exposure to China.”

Meanwhile, Yang Baorong, a director at the Chinese Academy of Social Sciences, emphasized that China’s financing is intended to foster self-reliance, not dependency.

As the dynamics of global finance shift, the authors of the report argue that China is becoming a “new global pace-setter,” forcing other major lenders like the U.S., Germany, and Japan to reevaluate their credit and aid strategies.

What Happens Next: The world will be watching closely as nations adapt to this evolving financial landscape. The implications of China’s unprecedented lending could redefine international aid norms and strategies, compelling other countries to act swiftly to respond to Beijing’s growing influence.

Stay tuned for more updates as this story develops.