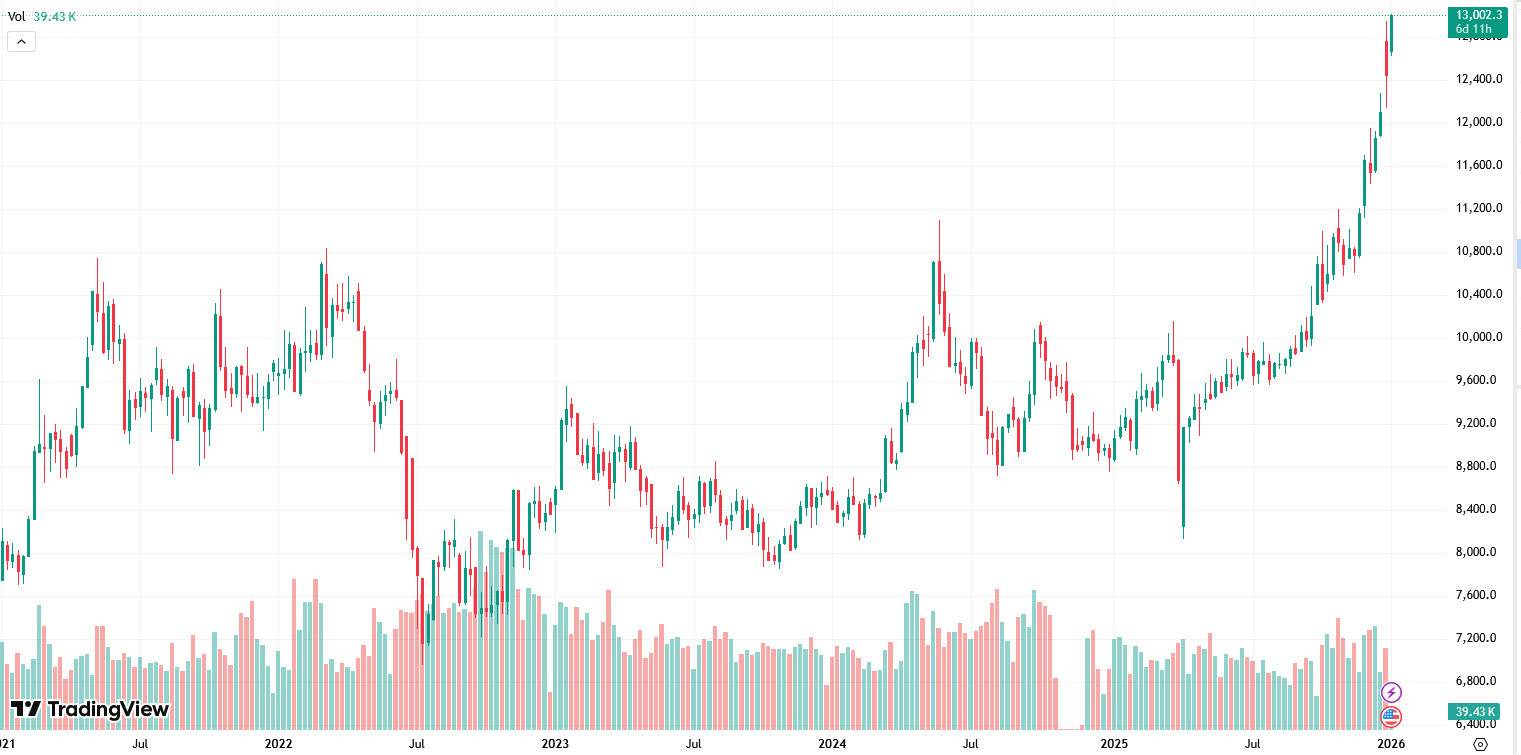

UPDATE: Copper prices have surged to a record high of $13,000 per ton, driven by significant supply disruptions and labor strikes. This unprecedented rise, confirmed earlier today, signals critical shifts in the global copper market as mining operations face mounting challenges.

The Capstone Copper Mantoverde Mine in the Atacama Region of Chile is currently operating at approximately 30% capacity following a strike by Union #2, which represents roughly half of the workforce. The strike commenced after failed mediation efforts, adding to the ongoing concerns over copper supply amidst already tight market conditions.

Analysts indicate that the strike could impact production levels between 29,000 and 32,000 tons during the affected period, exacerbating an already critical supply gap. This comes as the Grasberg Mine, one of the world’s largest, is anticipated to be offline for the entire year due to significant operational setbacks caused by a tragic mudslide last year.

The copper market is hyper-sensitive to these supply-side shocks, particularly with the ongoing outages in Indonesia. The loss of any additional tonnage now adds fuel to an already bullish market. Experts predict that the gradual return to production at Grasberg, expected to start in Q2, may not alleviate pressures in the short term.

This year’s labor unrest is indicative of broader issues within the Chilean mining sector. Negotiations are intensifying, with five separate union contracts at Codelco, Chile’s state-run copper giant, set to expire. Workers are demanding higher wages and improved safety conditions, which could lead to further disruptions.

Additionally, negotiations at the Centinela mine and impending discussions at Anglo American’s Los Bronces add to the mounting uncertainty in copper supply. As labor dissatisfaction grows, the potential for widespread strikes could significantly impact production levels across the country, which is home to many of the world’s largest copper mines.

Market analysts are keeping a close watch on these developments. The technical outlook suggests that copper prices could reach as high as $16,000 per ton by the end of the 2025 range if current trends continue.

As the situation unfolds, traders and investors should remain vigilant. The copper market’s immediate future is uncertain, and every development could trigger significant price fluctuations. For now, the combination of increasing demand and dwindling supply paints a concerning picture for industries reliant on copper.

Stay tuned for further updates as this story develops.